Mortgage Rates May Increase in 2017

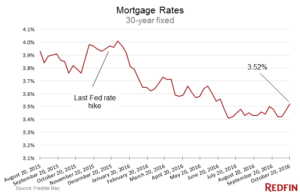

Mortgage rates were up this week, averaging 3.52 percent for a 30-year, fixed-rate loan, up from 3.47 percent last week. This is the first time in four months the rate has been above 3.50 percent. Last year at this time, rates were 3.70 percent, according to Freddie Mac.

A consensus is growing on what may happen in the near future with interest rates.

A consensus is growing on what may happen in the near future with interest rates.

What’s Expected in the Next Two Months?

People of all political stripes agree that the madness of this election season is worth waiting out. Janet Yellen and crew (a group also known as the Federal Open Market Committee, or FOMC) meet mere days before the election, on November 2, to discuss whether they’ll raise the Federal funds rate.

Heavy odds are they won’t. As of publication, there’s a 92.8 percent chance they’ll stay the same.

Instead, talk is on a recent run of okay-but-not-spectacular reports, that aren’t where economists hoped they’d be, but that might be good enough for the Federal Reserve to raise rates in December. For example, the most recent jobs report was described as “stubbornly average” by Redfin chief economist Nela Richardson, while economist Diane Swonk described it as “solid, not spectacular.”

Continuing this theme, Tuesday’s consumer price index was “in line with expectations,” according to CNBC, and revealed that year-over-year inflation was 1.5 percent, the highest it’s been since October 2014. That’s inching closer to the two percent the FOMC deems ideal, and a number that Bloomberg notes is consistent with a raise in rates in the coming holiday season.

What About Housing?

In many areas across the country, it’s a seller’s market. There simply aren’t many homes for sale, and it looks like we’re not going to get the relief we need in the near future.

Tuesday’s Housing Market Index, which measures home builder confidence in the market, continued the trend of lukewarm reports. Builder confidence was at its second-highest level this year – but down compared to the previous report.

Similarly, the Census Bureau’s release yesterday showed a decline on new construction starts last month, though with a rise in builders requesting permits to build in the future. This chart from the Federal Reserve Bank of St. Louis, shows that builders are still not building at historical norms, though they are building much more than in the in the recent past. Again, a mixed bag.

What Does It Mean For Homebuyers?

Baring a surprise next week at the FOMC meeting, mortgage rates are unlikely to rise significantly in the short term. However, mortgage rates may start to creep up in 2017, especially if the Fed rate is raised on December 14, with experts saying there is a 73.6 percent chance of that happening.

Baring a surprise next week at the FOMC meeting, mortgage rates are unlikely to rise significantly in the short term. However, mortgage rates may start to creep up in 2017, especially if the Fed rate is raised on December 14, with experts saying there is a 73.6 percent chance of that happening.

But, even with a hike, mortgage rates would likely stay very low by historical standards, as the chart indicates.

Perhaps the bigger question for homebuyers is not whether they can afford a mortgage in 2017, but whether the new year will have enough homes to satisfy demand.

Trackbacks & Pingbacks

[…] process of selling your house can be extremely stressful. But with rising rent costs and cheaper mortgage rates, many people are looking to become homeowners, so if you want to sell your home, now is a good […]

Leave a Reply

Want to join the discussion?Feel free to contribute!